What defines a great art gallery? Is it the quality of its dealer, or is it the works showcased? The answer is probably both, but the later often depends on the former. Without a talented dealer, there’s no real sense of guidance or taste in terms of defining the kind of work the gallery will exhibit. Here are three of the most important dealers at the forefront of design right now.

Maria Foerlev from Etage Projects, Copenhagen

In only three years after opening her gallery, the Danish dealer has been able to establish a solid reputation as a forward thinker. She’s known for having a keen sense of what’s next in art, fashion, and furniture. She was an early supporter of artists like Pettersen & Hein, known for their Brutalist sculptures, Sabine Marcelis and her neon-and-resin lights, and Thomas Poulsen, also known as FOS. Her refined taste comes from a combination of having a childhood immersed in art (she was raised in a house designed by none other than renowned Arne Jacobsen) and her studies at the Sotheby’s Institute of Art.

Patrick Parrish from the Patrick Parrish Gallery, New York City

Some people may know Patrick’s collections from his days when he dealt 90’s vintage design in Mondo Cane. But it wasn’t until 2010, via his blog Mondoblogo, that he became associated with conceptual furniture duo RO/LU from Minneapolis. The artistic pair were part of Patrick’s first contemporary exhibit at Mondo Cane, featuring furniture that referenced icons like Rudolph Schindler and Scott Burton. By 2014 he opened Patrick Parrish Gallery in Tribeca, where he now exhibits work from artists like Jesse Moretti (painting), Ian McDonald (architectural ceramics), and Marcus Tremonto (lighting).

Amaryllis Jacobs and Kwinten Lavigne from Maniera, Brussels

Amaryllis and Kwinten founded their gallery in 2014. They started off by sectioning off half of their apartment, which happens to be a former 1920’s lingerie factory, and inviting the public into their home. Known for commissioning artists and architects that make functional objects, today this couple has shown at places like Design Miami and sold numerous pieces to Belgian museums. As of late, they will finally be moving into a bigger exhibition space. Their first collection features works from Kersten Geers David Van Severen and architect Anne Holtrop. They also intend to showcase conceptual artists whose work is highly inspired by architecture.

Final Thoughts

As a collector, keeping an eye out for influential dealers is a great way to discover new artists, find truly unique pieces, and stay up to date on the latest artistic trends. Who are some of your favorite dealers?

As an art collector, a good rule of thumb is to buy what you like, not what you expect to appreciate in value at the fastest rate. First and foremost, it’s a collection and something to be appreciated and enjoyed. Secondarily, it’s an investment. And when it comes to investments, there’s always one tricky thing to figure out: inheritance. An increasingly important part of estate planning is figuring out what will happen to your art when you are no longer around to appreciate it.

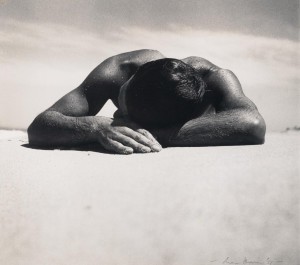

As an art collector, a good rule of thumb is to buy what you like, not what you expect to appreciate in value at the fastest rate. First and foremost, it’s a collection and something to be appreciated and enjoyed. Secondarily, it’s an investment. And when it comes to investments, there’s always one tricky thing to figure out: inheritance. An increasingly important part of estate planning is figuring out what will happen to your art when you are no longer around to appreciate it. The infamous Sunbaker picture by Max Dupain from 1937 will be on the move after Minter Ellison, the owners of a large collection will be transferring fantastic pieces to the highest bidder. The law firm Minter Ellison has had marvelous artwork hanging in their Sydney office for over fifteen years. Unfortunately, the firm is moving to a warehouse styled office, which means they will not need artwork hanging around the office. The company owns 56 pieces of artwork, estimated roughly just under $2 million US dollars.

The infamous Sunbaker picture by Max Dupain from 1937 will be on the move after Minter Ellison, the owners of a large collection will be transferring fantastic pieces to the highest bidder. The law firm Minter Ellison has had marvelous artwork hanging in their Sydney office for over fifteen years. Unfortunately, the firm is moving to a warehouse styled office, which means they will not need artwork hanging around the office. The company owns 56 pieces of artwork, estimated roughly just under $2 million US dollars.